Many mature industries are experiencing significant technological disruption. The automotive industry is being disrupted by electric vehicles and self-driving cars, just as home appliances is being disrupted by the Internet of Things and smart appliances, home entertainment by on-demand content providers, and apparel by online personal stylists such as Stitch Fix and Trunk Club.

Leaders in every industry are no doubt keeping a vigilant eye on such developments, yet one very important aspect of this disruption has been largely overlooked: technology fundamentally changes what makes your brand premium.

The traditional drivers of brand premium are being joined (and to varying degrees supplanted) by newer, tech-enabled variables: software, interactive products, digital interactions, immersive experiences, and predictive services, to name a few. Product: hardware vs. software. While hardware currently accounts for 90% of the perceived value of a car, Morgan Stanley predicts that percentage will eventually drop to just 40%, with the remaining 60% being dominated by the car’s software and content.

Product: mechanical vs. interactive. Premium car brand buyers were traditionally satisfied with a high-performing, safe, and luxurious driving experience. However, in the digital age, drivers increasingly expect their car to also be a smart device on wheels that keeps them constantly connected, makes them safer and better-informed drivers, while also entertaining them. Our conversations with automotive industry leaders suggest there will be significant growth over the next several years in premium brand cars equipped with large-screen infotainment systems, large LCD dashboards, and augmented reality head up displays. Marketing and sales: offline vs. online. Brand marketing and the car buying experience have always been integral to being a premium automotive brand, and the majority of those crucial interactions have already moved online. In its study of “The Shifting Automotive Shopping Landscape,” TNS Global reports that premium car owners experience an average of 8.9 touch points during the purchase process, of which 5.5 occur online. And while only 2% of today’s car buyers purchased their car online, 77% say they anticipate purchasing cars online in the future.

Marketing and sales: emotional vs. experiential. Automakers have long known that the more premium a car brand is, the more emotion factors into brand perception, which is why premium brand marketing makes consumers anticipate serene gratification. However, experientially engaging car buyers may soon be as essential. A recent consumer survey revealed that 82% of current car owners and potential car buyers want to explore and configure their vehicle via immersive technologies like virtual and artificial reality. Premium brands need to do more than keep pace with industrywide efforts to provide such experiences — they need to lead them, or face surrendering a key element of their brand’s cachet.

Services: offline vs. online. Our review of historical data and major automakers’ announced plans indicates that connectivity devices in cars will increase from 22% in 2017 to 69% by 2020, laying the foundation for automakers to significantly lessen the need for car owners to bring their vehicle to a facility for maintenance. The rapid growth of electronic vehicles (EV) will further accelerate the shift to online services, since the EV structure greatly simplifies after-sales maintenance. The majority of service touch points may soon move online. Again, customers will expect premium brands to be ahead of the curve in providing after-sale car service convenience.

Services: real-time vs. predictive maintenance. Increased connectivity will also make predictive maintenance the main service mode, as automakers will continuously capture and rapidly analyze massive data on driving behavior, road conditions, and other variables to anticipate and finely hone vehicle service. A World Economic Forum white paper predicts remote diagnostics, enabled by telematics, will add $60 billion of profits to OEMs, suppliers, and telematics service providers through 2025. An IoT Analytics study spanning 13 industries, including automotive, found that predictive maintenance solutions being achieved today deliver 20%-25% efficiency gains, and forecast the revenue opportunity in predictive maintenance will increase at a compound annual growth rate of 39% over the next five years.

Brand equity: heritage vs. digital. A cumulative effect of the shifts described above may be a diminished value of brand heritage, relative to a rising premium on consumer-pleasing digital innovation. This final and most strategic shift could create a historic opening for new automakers — including EV makers in developing countries such as China, and self-driving/EV start-ups by internet companies. Proprietary research A.T. Kearney conducted for a client found that 45% of car owners would switch from their current brand to a vehicle offered by a tech company new to the automotive industry. Data-savvy automotive start-ups that use customer-centric thinking to guide their innovative prowess could significantly undermine even the most esteemed premium brands.

In sum, a reshuffle of premium brands is near. Established premium brands who choose to go on relying exclusively or even primarily on their traditional strengths could soon lose much of their ability to attract consumers and to grow or hold market share, while new brands may be able to gain premium standing much more quickly than was ever before possible. For example, Tesla required only about a decade to establish itself as a premium brand.

How can established premium automakers best react?

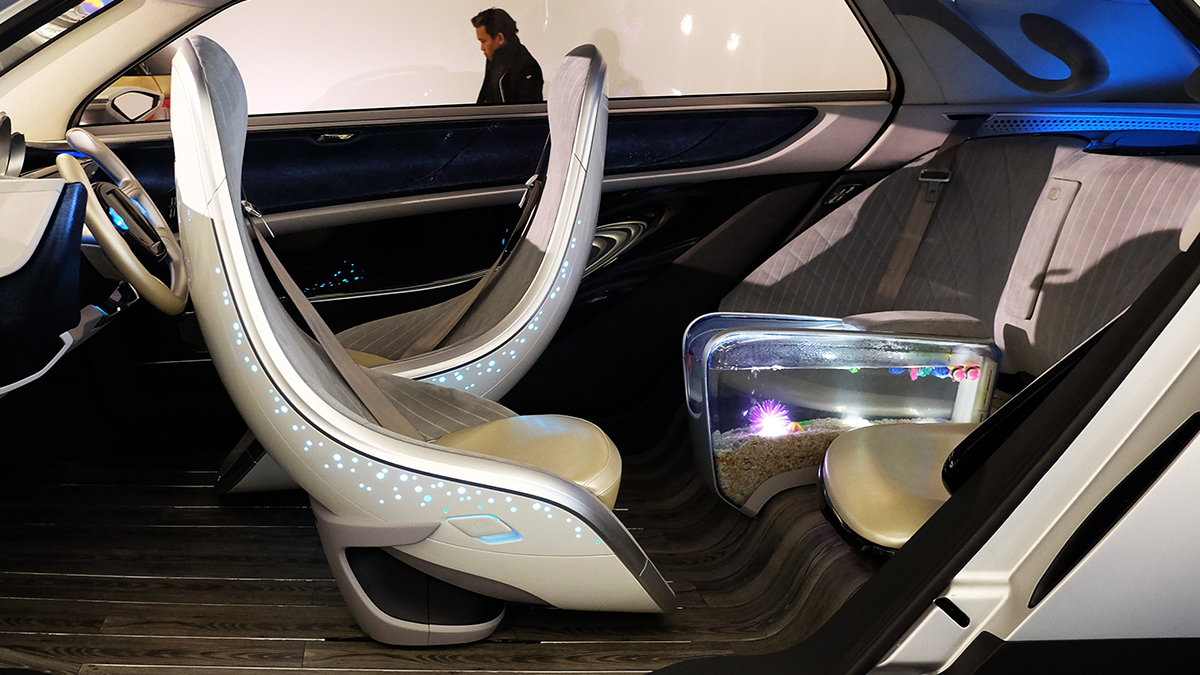

Realistically assess the staying power of the qualities that made your brand premium in the past, in light of the new variables now reshaping brand premium in the automotive industry. Will what you offer today still be perceived as premium in five or 10 years? For example, superior driving experience is currently a hallmark of most premium automotive brands. However, as autonomous driving advances, the experience of being in a car will be much like being in a mobile lounge, where the occupants will expect to do almost everything they can do in the office or at home. To maintain premium brand status, OEMs need to make great leaps in providing seamless digital integration in automobiles.

Premium automotive brands also need to transform marketing and sales from today’s push system to a pull system that engages customers via digital interactions that are transparent, time efficient, and pleasingly experiential.

Further, it will be impossible for OEMs to innovate at the requisite pace entirely through their company’s own proprietary R&D. Rather, they will need to build and support innovation ecosystems with newly essential forms of expertise not to be found within the automotive industry, including specialists for battery cells, 2D/3D sensors, AI/algorithms, HD maps, app development, cloud computing, and communication infrastructure. One example of this trend in motion is the Open Automotive Alliance composed of a range of prestigious automotive brands and technology partners.

Automotive OEMs that are unwilling or unable to be a leader in leveraging new technologies to deliver brand premium could choose to become a more mainstream brand. The goal will then be to cost-effectively produce automobiles that can compete on the basis of affordable value. Companies that choose such a course should concentrate their investments in excellence in mass manufacturing, rather than in being among the first to embed new technologies that dazzle high-end buyers.

The choice is truly that stark. Given how radically technology is changing the definition of premium across automotive product, marketing and sales, services, and brand equity, the status quo is not viable. OEMs must dramatically diversify their investments in being a premium brand, or see their claims to premium status inevitably slip away.